What am I looking at when I look at a Copy of W2?

The W-2 is an IRS document noting your wages and tax withholding for any job you worked for the previous year. The online W2 form is used by your company or employer to report how much money each employee earned and how much in taxes were paid to the IRS through their withholdings. Any hourly, salary, or compensated job where an employee worked, even for a day, would get a W-2 form from that employer for that tax season.

It is the employer's job to mail out the W2 copy to employees by January 31 each calendar year. This gives people ample time to file and receive their refund by April 15th. The W-2 wages and withholdings statement is also reported to the Social Security Administration. The Internal Revenue Service and Social Security Administration keep close communication to monitor each individual's taxes and income because they receive a copy of w2 including copies of past w2s. You should be aware that the IRS receives a w2 express download from your employer every year so they know exactly how much you make whether or not you file your w2 copy or not. Important to note is that the IRS gets an online w2 copy from each and every job you had even if you had 4 part time jobs and one full time job.

The first step to follow when you're getting ready to fill out your taxes is to compile together all the W-2's for the jobs you've worked at during the past year. The online W2 is designed to be easy to read and follow and the IRS organizes it accordingly: boxes 1-14 report federal income and withholdings while boxes 15-20 refer to state info. Don't worry if not every single box is filled out or if some are blank; this is usual because your employer only fills out what pertains to you and is necessary. If you find any errors with your personal information on your copy of W2 form, ask your employer to send you a corrected w2 copy. You must still file your taxes online correctly with the IRS even if your lost copy of w2 is incorrect.

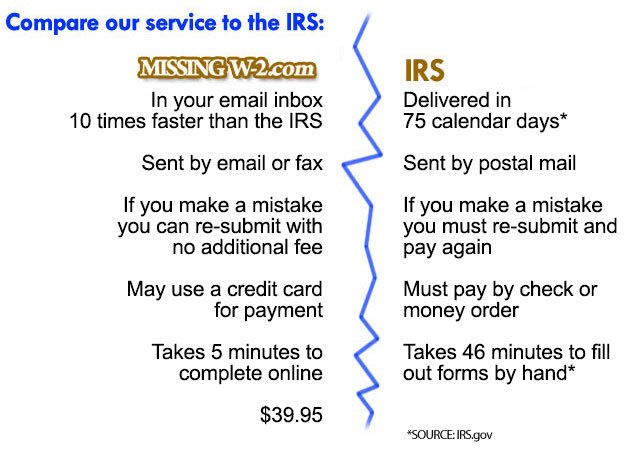

If you find that it's past the end of January and you still haven't gotten your lost W2 download, ask your employer to request a copy of w2 from HR. Some might ask for a small service fee to do so but most should supply it. If you can’t get one from them its nice to know you can get an online w2 copy… right here.

MissingW2.com, Get Your Missing W-2 Forms Quick and Easy

Copyright 2024 | Terms & Conditions | Privacy Policy | Get Started