How to Get a New Copy of W2 Online

A wage and tax statement, better known as the W2 form, is handed out to taxpayers by their employers every year. After you've received your copy of W2, it's your responsibility to fill out your tax return and file it to the IRS before the deadline, either by postal mail or over the Internet. If for some reason you haven't received your copy of W2 from your employer, you have a long and difficult replacement process ahead of you, unless you choose to get your new copy of W2 online through our website.

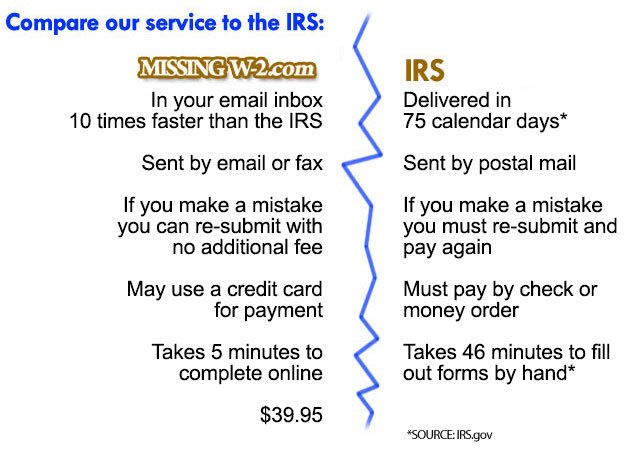

While the IRS, SSA or your employer might be able to provide you with assistance in getting you a new copy of W2 documents, you first have to get someone to help you. Even if you do get in touch with someone who can help, you could end up waiting over a month for your copy of W2 to arrive in your mailbox. Using our website instead, you can get a new copy of W2 online, by yourself, without needing anyone else to help you.

If you want to save yourself all of the trouble of getting your new copy of W2 forms from your employer or the IRS, and sign up for a free account at MissingW-2.com and see for yourself how our reliable copy of W2 recovery service works. We specialize retrieving new copy of W2 forms that you may have lost, misplaced or never received. Your new copy of W2 will be sent directly to your email, and you won't have to waste any time waiting for the postal mail to arrive. By taking the online route, you also free yourself of most fees that come with getting your copy of W2 from the IRS, including the resubmission costs the IRS charges if you make a mistake.

By law, all employers must distribute W2s by January 31st every year. However, it is not uncommon for these tax forms to be lost in the mail, never arrive, or even worse, you did receive your copy of W2 and you just can't remember where you filed it away. Trying to get a new copy of W2 from your employer's Human Resources could be hard to do, and it might even be impossible to get a new copy of W2 if you are no longer working at that company or even worse, if that company closed or went out of business. The good news is that our website offers online W2 recovery to get you a new copy of W2. It is worth the small fee that we charge just so that you don't have to try to find the right person to talk to in your company, or your old company to reissue a copy of W2 tax forms for you. Our website's online process to find your missing W2 only takes a few minutes to complete and we email you an exact PDF copy of W2 that is 100% acceptable to the IRS. It's no wonder that more and more taxpayers trust us to get an old or lost copy of W2 tax form year after year because of the convenience, speed and lower cost. Be careful of our competitors, not every company that claims to recover your W2 online or offline will be able to provide a quality service.

If you request a replacement copy of W2 from anywhere but our website, you will most likely receive it in paper form and will have to remember not to misplace this new and only copy of W2 or waste time with scanning it on your computer.

When you get your copy of W2 tax form emailed to you from us, it can be used exactly like the old lost W2 tax form that you misplaced. It will look exactly the same as the original, so using the W2 to file late taxes will be easy. When the website says “see box 1 on your W2” you can be confident that the Box 1 you're looking at is the exact same as what you would have seen on the original tax document that you lost recovery of your lost W2 form than using any other method. All you have to do to get a fresh copy of W2 is prepare all the relevant details and sign up for a free account at MissingW-2.com

MissingW2.com, U.S. Patent No. 8,099,341 Missing W-2 Forms Quick and Easy

©Copyright 2010-2024 | Terms & Conditions | Privacy Policy | Get Started

Copy of W2 | Express W2 | Lost W2 | Online W2 | W2 Online

Reach us by Phone: 888-W2-MISSING or Email: help@missingW-2.com